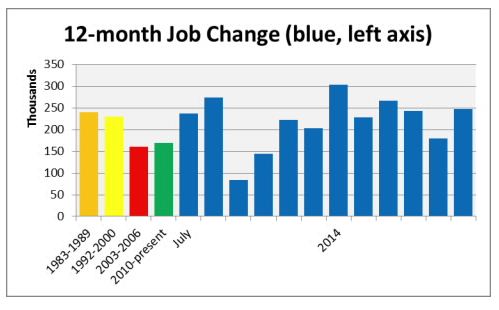

After faltering in August, headline payroll employment growth snapped back in September with the addition of 248,000 jobs. What’s more, the August figure was revised upward by 38,000 jobs.

After faltering in August, headline payroll employment growth snapped back in September with the addition of 248,000 jobs. What’s more, the August figure was revised upward by 38,000 jobs.

The unemployment rate eased to 5.9% as a result, the first time under 6.0% since July 2008. This figure is derived from a different survey, which queries households about their employment position. Consequently, non-payroll jobs are counted. This survey also measures labor participation, which is a gauge of the share of persons employed or actively looking for work and provides insight into discouraged workers and underutilization. This measure slipped further to 62.7% in September. Studies suggest that the low participation could reflect an increase in early retirements, while others argue it is suggestive of slack in the labor market.

The strongest gains in employment came in the professional and business services, retail trade, and health care sectors.

Wage growth was revised slightly upward in August, while the September reading was flat. Tepid wage growth is a negative for home purchase affordability and could act as a headwind for price growth. However limited wage growth removes the specter of inflation giving the Fed more room to maneuver without raising mortgage rates, a more immediate threat to affordability. Prices will still grow given an expanding buyer base relative to limited supply.

This month’s reading of the labor market was a strong reversion back to the recent storyline of steady economic expansion. Modest wage growth and labor underutilization could create an opening for improved employment and confidence without a near-term spike in mortgage rates as many have feared. However, recent weakness in manufacturing figures and consumer confidence suggest softening in October.