The California real estate market experienced considerable shifts in the past 12-18 months leading up to September 2023, influenced by high mortgage interest rates and record-high home prices. These factors significantly impacted buyer and seller behaviors, reflecting on the month’s sales and price trends.

Market Overview

The pace of the California real estate market moderated in September 2023 compared to the active summer months. As reported by the California Association of Realtors, the total number of home sales was 240,940 on a seasonally adjusted annualized rate, a 5.4% decrease from August and a 21.5% decline from September 2022. The median home price was $843,340, a 1.9% dip from August but a 3.2% increase from September 2022.

Looking at the sales pace, we can see buyers taking a step back and assessing the combination of high rates and high home prices. This is more than a whimsical decision, it is fundamentally, at this time, a matter of affordability. Many buyers have been completely priced out fo the market due to rising home prices. The jump in mortgage rates in the past 12 months is the final straw for many aspiring homeowners.

Sales Performance

Sales performance in September 2023 showed the market’s reaction to high-interest rates. The cost of borrowing increased, causing potential buyers to be more cautious, leading to decreased sales activity. According to Redfin, there were 21,154 homes sold in California for September, a 21.4% decrease from the year before. Housing supply was also reportedly 23.6% lower from the year prior.

It’s a very interesting time. Prices are still climbing year over year, although there seems to be stress in the market month over month. As mortgage rates continue to climb and inventory shrinks due to sellers not finding a compelling reason to trade their current 3.5 mortgage for a bigger mortgage at over 8% as of now, the rest of the year outlook will probably not improve dramatically, if at all.

Regional Breakdown

Regions across California showed different market trends. Major regions like the San Francisco Bay Area and Central Valley saw significant drops in annual sales, while counties like Mono, Sutter, and Madera witnessed an increase in sales, possibly due to better affordability and appeal to buyers.

Let’s take a look at what our neck of the woods looks like here in southern California.

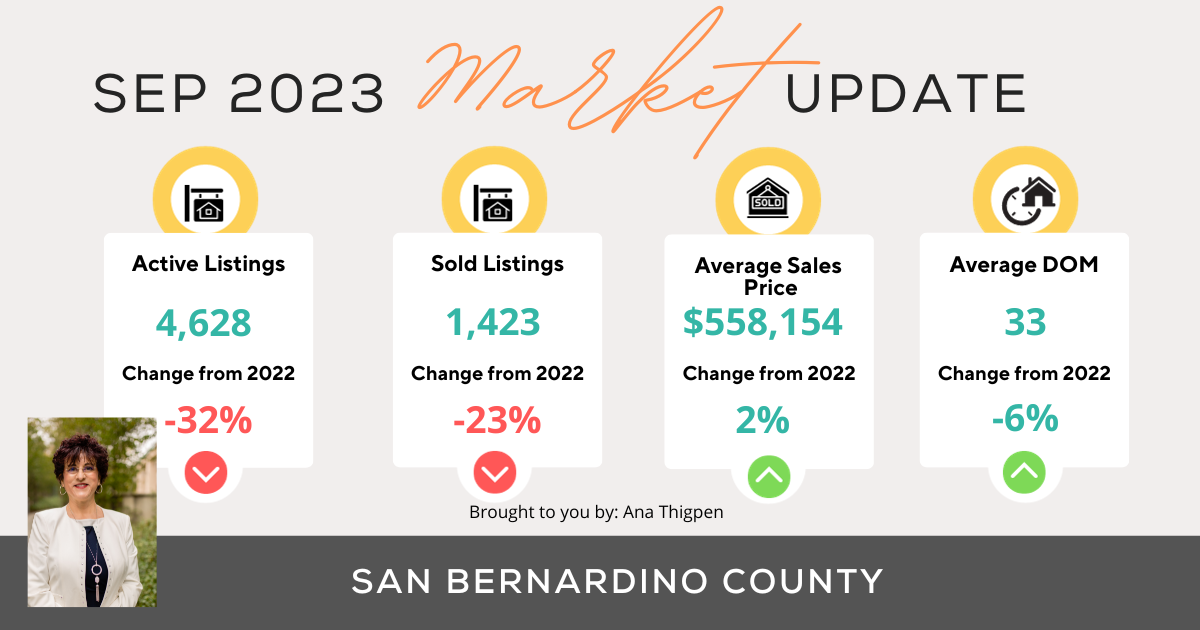

San Bernardino County

The average sales price of homes in San Bernardino County came in at $558,154 for Sept 2023. This was practically flat compared to the previous month and a slight increase of 1.8% from last year.

There were 4,628 active listings in September, practically the same as the month before, but there was a marked decline of 32.3% from the year before.

Closed sales for the month were 1,413, a notable drop of 12% from the month before and a significant drop of 23% from the prior year.

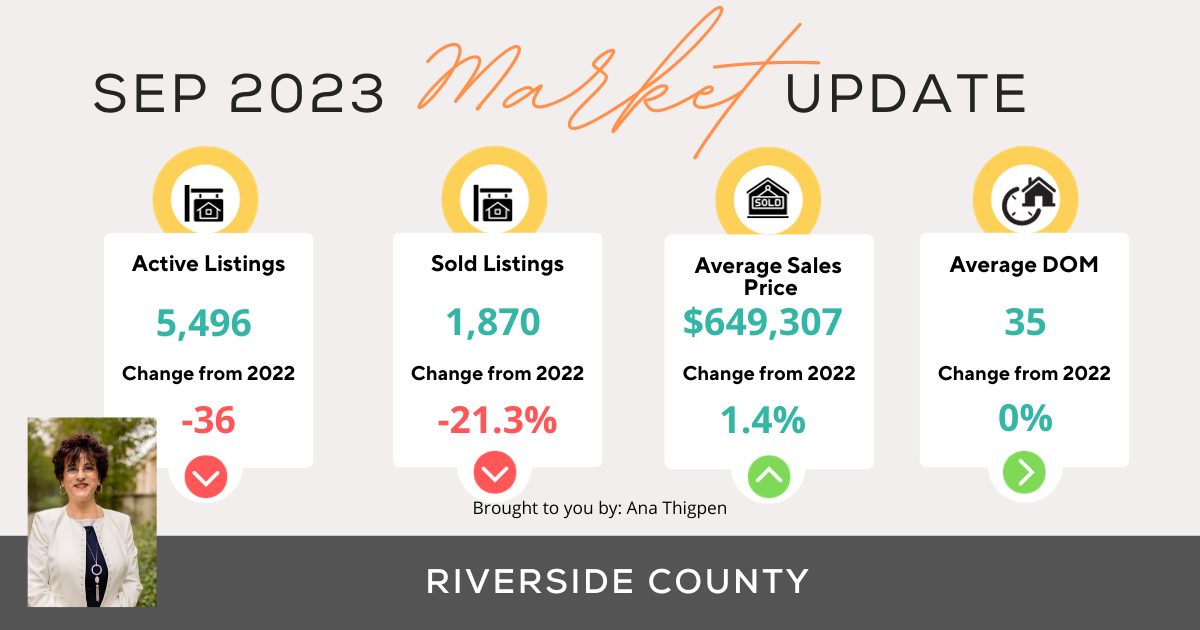

Riverside County

The average sales price of homes in Riverside County came in at $649,307 for Sept 2023. There was a slight dip of 1.4% compared to the previous month and a slight increase of 1.4% from last year.

There were 5,496 active listings in September, practically the same as the month before, but a marked decline of 36.3% from the previous year.

Closed sales for the month were 1,870, a notable drop of 14% from the month before and a significant drop of 21% from the prior year.

Overall, sales are down year over year for both counties, and prices are slightly up for the same period.

Buyer and Seller Behavior

High interest rates brought about caution among buyers and sellers for the same reasons, interestingly enough. Due to higher rates, buyers are concerned about affording their new purchase in this market. Sellers, on the other hand, are feeling “mortgage locked” by their current mortgage’s low rate. They don’t want to get rid of that 3.5% and buy a house with a bigger mortgage at more than twice their current rate.

In some areas, this has meant slightly longer market times for sellers. Some sellers adjusted their strategies by offering concessions to attract buyers, such as price adjustments or covering some closing costs.

Key Takeaways

Sales Performance: Sales decrease is a reflection of higher interest rates affecting buyer confidence.

Price Trends: Stable home prices indicate the market’s inherent strength despite economic pressures.

Regional Dynamics: Varied regional trends highlight the diverse market conditions within California.

Market Behavior: The shift towards a more balanced market dynamics is evident with the change in buyer and seller behaviors.

Recommendations

For Buyers:

- You can do assumable loans on properties whose sellers have FHA, VA, or USDA loans and get a 2nd loan for the difference if it makes sense.

- If you can afford the payment, buy now and refinance later. If you wait for the rates to go down, you will have more competition.

- The CalHFA has a new allocation for the California Dream for all shared Programs, which will provide around $200 million for the down payment for first-time homebuyers. Per Fiona Ma, CPA, California State Treasurer, the new allocation will be given to buyers whose parents don’t own a home. These buyers are encouraged to submit the loan application/documents to their lender so they can be ready when this program is released.

For Sellers:

- Be prepared for longer market times and adjust pricing strategies accordingly.

- Offer concessions to attract buyers in a market where buyers are cautious.

- Stay updated on regional market trends to better strategize your sale.

- Look for homes with assumable loans if it makes sense for you.

The insights from September 2023’s market dynamics provide a roadmap for buyers and sellers to navigate the California real estate market effectively.

As you may gather, navigating today’s real estate market on your own may prove to be “challenging” to say the least. If you’d like advice from a veteran in the business, someone who has seen the ups and downs of the market here in the Inland Empire, I am happy to put my experience to work for you.