Mortgage Rates Drop Over 1.5% Since Recent Peak: What It Means for Southern California Homebuyers and Sellers.

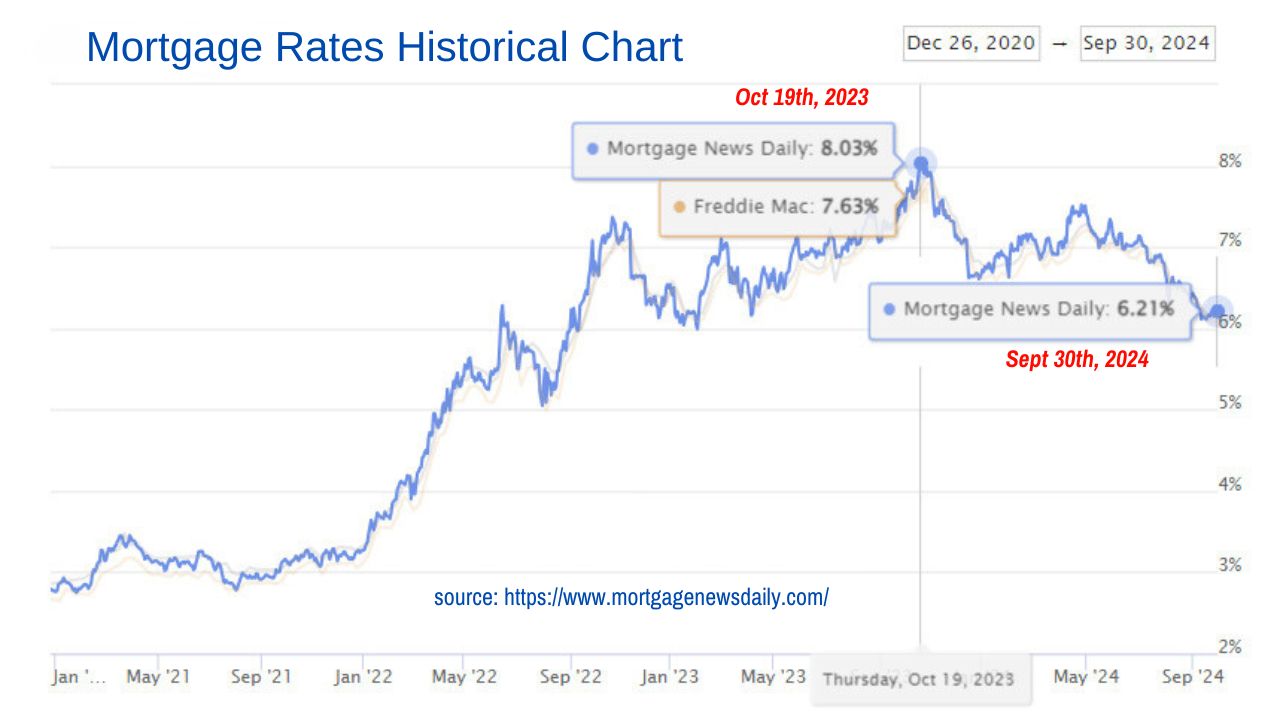

As of late 2024, mortgage rates have seen a notable drop of over 1.5% from their peak of around 8.0% in late 2023. As of Sept 30th, the average 30-year fixed-rate mortgage hovers around 6.2%, offering much-needed relief to prospective homebuyers and those considering refinancing their existing loans.

For Southern California, where affordability has been a significant challenge, this dip in rates opoens a lot of doors for buyers and sellers alike.

The State of Mortgage Rates in 2024

After a rocky 2023 where rates soared to their highest in over two decades, mortgage rates are finally retreating. As of September 2024, the average rate for a 30-year fixed mortgage is approximately 6.2%, down from its peak of just over 8% a year prior.

This downward shift can largely be attributed to the Federal Reserve’s easing of interest rate hikes as inflation begins to cool and the economy shows signs of slowing. While rates are still high compared to the historically low rates of the pandemic era, they are now more manageable for many buyers.

Affordability in Southern California

For homebuyers in Southern California—especially in high-demand areas like Riverside and San Bernardino counties—the drop in mortgage rates is a welcome relief. This region has struggled with some of the lowest housing affordability levels in the country due to the combination of high home prices and the sharp rise in mortgage rates over the past few years.

The Inland Empire, known for relatively more affordable homes compared to coastal counties like Los Angeles and Orange, has still experienced price surges that make purchasing difficult for many first-time buyers.

Despite the recent reduction in mortgage rates, affordability remains a challenge.

Even with rates hovering around 6.2%, monthly mortgage payments for a median-priced home in Riverside County—where the median home price exceeds $550,000—are still steep for the average household. This is especially true for middle- or lower-income households, as home prices remain high, and income growth has not kept pace.

Impact on Homebuyers

For buyers, the dip in mortgage rates offers some relief in the form of lower monthly payments. For instance, a 1.5% reduction in the mortgage rate could reduce monthly payments on a $500,000 loan by over $400, which can make a significant difference over time.

Buyers who were previously priced out due to the higher rates in 2023 may now find it easier to qualify for a loan or afford a home in a desirable neighborhood.

However, buyers should remain cautious. While lower rates might increase purchasing power, Southern California’s tight housing inventory continues to drive up home prices. Many buyers, especially those new to the market, may still face stiffer competition and bidding wars, which had subsided during the higher rate months.

Buyers should also consider the possibility that rates could rise again, as the current economic environment remains uncertain. Locking in a favorable rate now may be a wise decision, especially for those who are ready to buy.

The Seller’s Perspective

For sellers, the falling mortgage rates present a win-win. Homes should be selling faster, perhaps at better prices, now that demand will be increasing with the lower rates.

The 2nd win is that when sellers go find their next home, they won’t feel as squeezed as they felt when they had to give up the cushy 3.75% for a rate that wast more than twice that, in the high 7s. The shift from 3.75% to 6.2% range will be far more palatable.

Refinancing Opportunities

The drop in rates opens up opportunities for refinancing for current homeowners. Many homeowners who locked in higher rates during higher rates periods may find it advantageous to refinance at today’s lower rates, potentially saving hundreds of dollars per month on their mortgage payments.

For those who bought a home during the recent peak at around 8%, this is an opportunity to save hundreds of dollars a month by lowering their rate. In some cases, they may even be able to drop their mortgage insurance if prices have gone up enough for them to do so.

What’s Next for Mortgage Rates?

Experts predict that mortgage rates will continue to hover in the 6% range for the rest of 2024, with some expecting further declines in 2025. The Federal Reserve is likely to cut interest rates due to lower inflation. The direction of mortgage rates will depend on overall economic factors like employment, inflation, and consumer spending.

For now, people buying and selling homes in Southern California should be cautious. If you’re buying, the current interest rates make it a good time to jump into the market, but you’ll need to be patient and have a good plan to get a home in a competitive market. If you’re selling, things are looking great for you, demand will rise, inventory is still dismally short, so you are in the driver’s seat!.

Bottom Line

The 1.5% drop in mortgage rates since their peak offers much-needed relief to the Southern California housing market, but affordability remains a pressing issue. Buyers may find more flexibility in their budgets, while sellers might see increased buyer interest.

However, the high home prices in areas like the Inland Empire continue to pose challenges. As rates stabilize, both buyers and sellers should carefully consider their timing and financial situation to make the most of the market.