The talk of the town nowadays is “The Housing Market”! Here in Southern California, we have a truly perplexing environment that in some ways, is hard to wrap our heads around.

As we look back on the past three years since the pandemic started, the market has been on a fierce rising trend. Even as mortgage interest rates have more than doubled ove the past year or so, the demand for housing seems unabated.

Today, we are going to take a deep dive into the numbers for San Bernardino County to give you, seller or buyer, the facts and truths about the numbers. Let’s dive in!

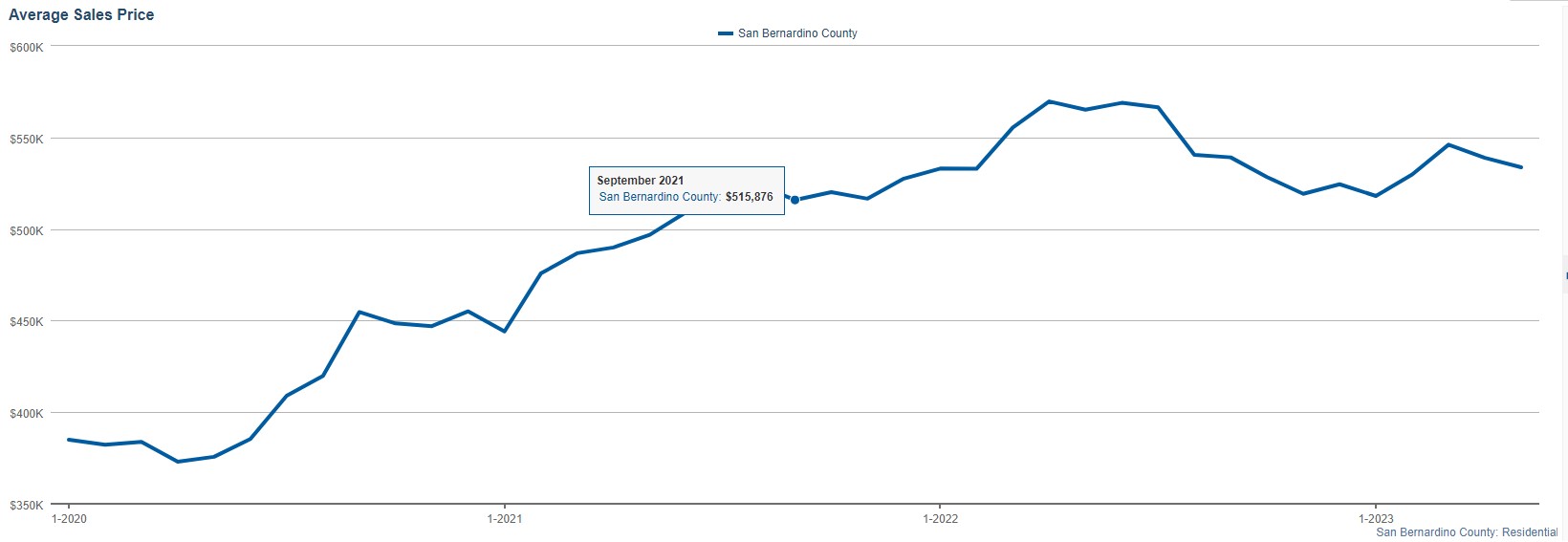

Home Prices

The first thing we are going to look at is what home prices have been doing for the past six months, and we will look at what’s happened since the pandemic.

The average sales price in San Bernardino in May 2023 was $533,712 which is 1% lower than the prior month and down 5.6% from May of last year. Contrast to Jan 2020, just before the pandemic, prices are up a whopping 39%.

Number Of Homes Sold

Sales in San Bernardino County is a mixed bag of news. In May, there were 1,716 homes sold, up from the month before by 17.5% and down 20% from the year before in May of 2022. We can attribute the year-over-year decline to declining inventory and fewer people qualifying due to the spike in mortgage rates. Comparing the number of closings to Jan 2020, we are down just 10% which is better than most counties in Southern California. San Bernadino’s relative affordability is what is supporting the market right now.

Active Listing

The number of homes available in May 2023 was 3,845 which was slightly up from the month before when we had 3,749 available homes. Year to date though, we are down 19% in active listings. Again, if we compare to Jan 2020, available homes for sale are down by 83%. This is not good news for buyers but great news for sellers who may want to sell their homes this summer.

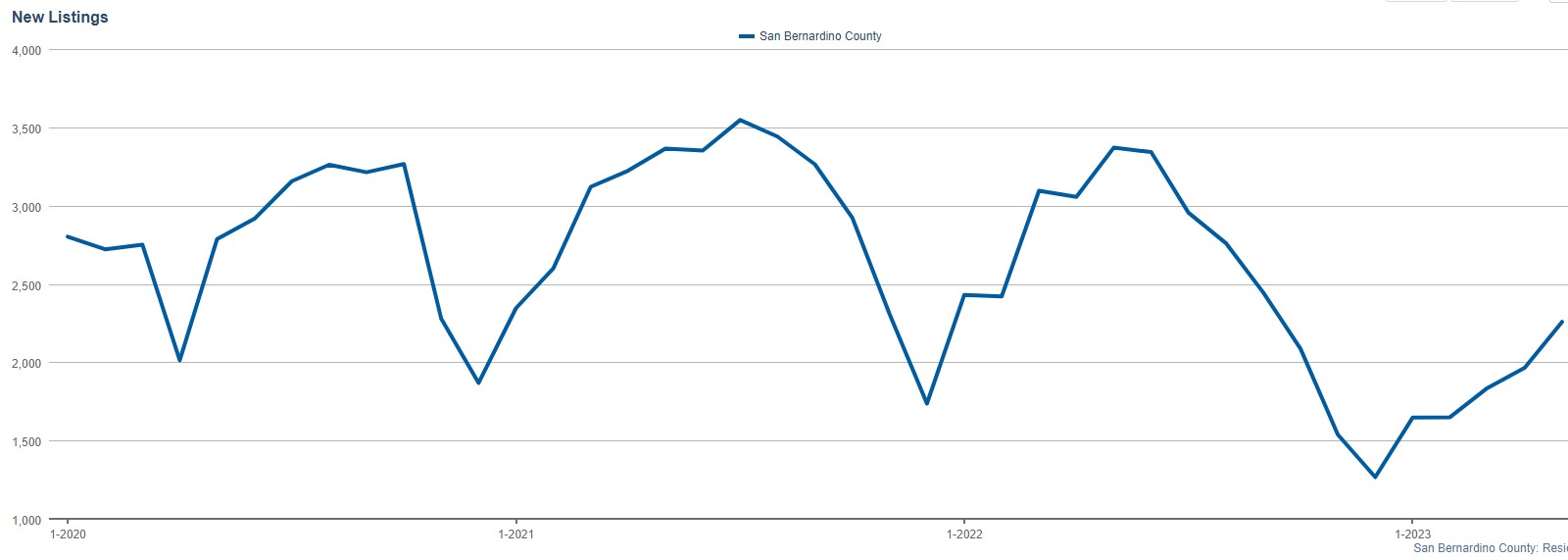

New Listings

Now let’s take a look at how many new properties came on the market. In May of 2023 we had 2,253 new listings come on the market, up 14.7% from the month prior and down 33% from the same month 2022. Year to date we are up 37% in new listings which should provide some relief for home buyers over the next couple of months.

Months of Inventory Supply

Now we shift over to another very key metric, the month’s supply of inventory. This is the measure at which we run out of homes for sale at the current monthly run rate. In May 2023, we had 2.5 months’ worth of inventory, a very tight seller’s market. Inventory is down 7% from January of this year and compared to Jan 2020, month’s supply of homes is down by 75%.

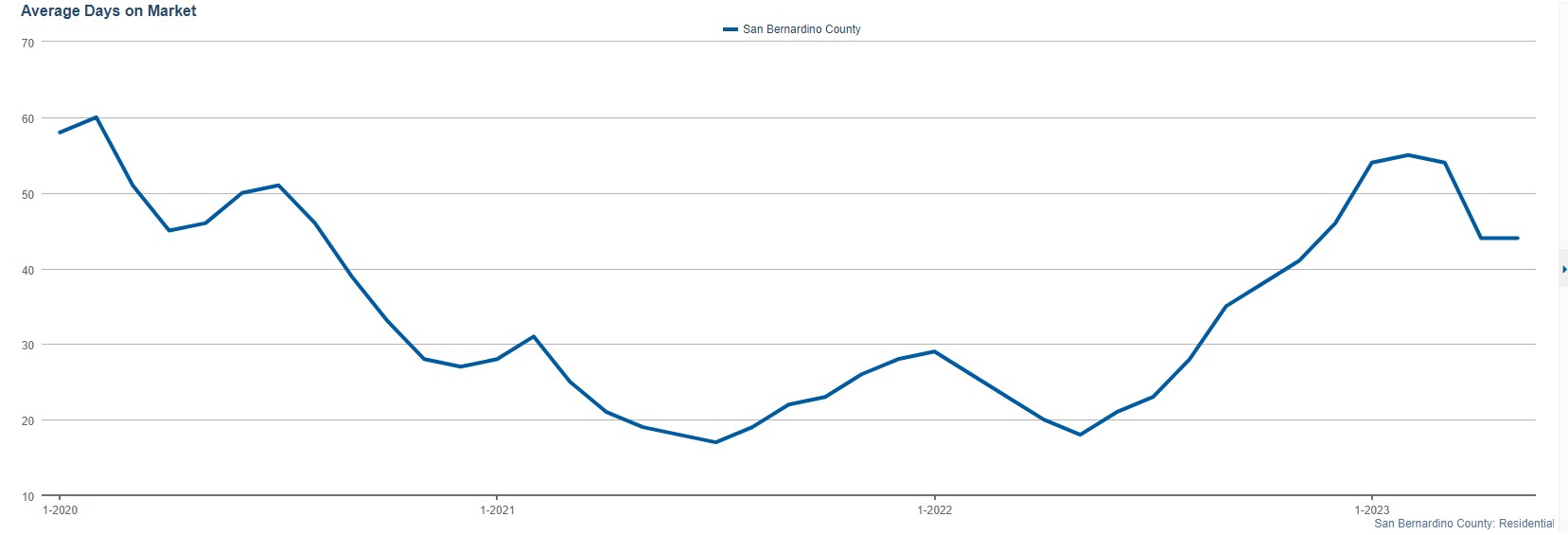

Days on The Market

The last metric we will review is how long it takes on average to sell a house in San Bernardino County. This is an interesting result, in May of 2023 the average number of days on the market was 44, unchanged from the month before. However, compared to May of 2022 when it was taking 18 days on average to sell a home, the time on the market has gone up by almost 150%. This is a bit of a mystery because inventory is down and demand seems to be up by all standards, yet, homes are lingering on the market much longer than last year.

Admittedly, 44 days on the market is still a seller’s market so we are not looking at a significant market shift by any means. Year-to-date days on the market are down by 19% and compared to Jan 2020, down 24%. This is a reflection of what we see on the market every day, people want homes!

Market Sentiment

In San Bernardino County, the market is strong and favoring sellers right now. Those of us with boots on the ground, listing and selling homes, can feel the air of activity. Although things started to look a little gloomy at the beginning of the year, we are seeing a strong rebound in demand over the last couple of months.

For Sellers:

This is a great time to sell your house if you are considering doing so in the next 12 months. In San Bernardino County, there is definitely a huge demand for homes so you are likely to sell fast and at top dollar. That is what we see taking place in the market right now.

For Buyers:

There is no denying that it’s a bit of a tough market right now. Prices are high and mortgage rates are taking a lot of people out of the market. Many would-be buyers are mourning the loss of rates in the 3% range and are hoping rates will come down again. Although mortgage rates may come down slightly once the anti-inflationary measures by the Feds have run their course, it is highly unlikely that rates will return to the levels of sub-5 percent. Over the last 50 years, that has only happened for about a decade. From Early 2010 to early 2022 mortgage rates stayed below 5% for an entire decade for the first time in history. With exception of that timeframe, the average mortgage rate has been right about 7% for the last 50 years. See chart below.

If you are thinking about buying and you can afford to stretch your checkbook for a house payment instead of rent, you may want to just take the plunge as many are doing right now. One thing is for sure, rents are not getting any cheaper. At least when you own a home, you cap your monthly housing expense with the possibility of paying less if rates do come down. There is rarely a downside to buying a home over the long run.

In conclusion, the San Bernardino County housing market displays strength and resilience, providing opportunities for sellers and prompting buyers to make strategic decisions. The market has witnessed remarkable price increases, shifting buyer and seller dynamics, and an overall sense of robustness. This report serves as a guide to navigating the current landscape, empowering individuals to make informed choices as they consider their next move within the housing market in San Bernardino County, California.