The first half of 2022 is behind us, and it was a very eventful six months in the Real Estate market. As of mid-July, we can look back at record-high home prices and the highest mortgage rates in over ten years. As we see these events take place, we can see the Real Estate market changing.

Let’s take a closer look at the market areas with the most significant changes.

Home Prices Are Flattening

Of all the events that happened in the Real Estate market during the 2nd Quarter of 2022, the shift in home values is the most significant of all. Southern California Home prices are beginning to soften.

Looking at the image below, you can see that from the beginning of the 2nd quarter to the end of the quarter, prices started to decline in two of the three counties shown. Only one county experienced a slight increase in the average home price; Los Angeles County. Orange County had the most significant drop in the average home price, followed by Riverside County.

Mortgage Rates Rising

The event that has had the most significant impact on the recent change in the market is the sharp rise in mortgage interest rates. In early 2022 we were looking at rates in the low threes; in mid-June, rates went up as high as the low sixes. That is a 100% increase in rates in just six months.

As you may imagine, or perhaps experienced yourself, when the rate on the mortgage on that house you were thinking of buying doubles, it directly impacts whether or not you buy that home.

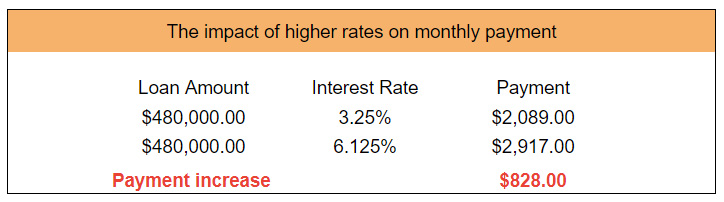

For example, If we take an average house of $600,000 with a 20% down payment and loan amount of $480,000, a very common purchase price in all four SoCal counties, we can see the impact of mortgage rates on the monthly payment.

In just six months, someone looking to buy a home in this price range had their anticipated payment go up by 40%. Considering how home prices are also going up, it is safe to assume that the mortgage payment went up by 50% or more for the same house.

This drastic increase in monthly housing costs is why we are seeing the market shift, not just here in California but across the country.

Record High Inflation Rates

The 2nd most impactful event that is driving the change in the market is record high inflation. The Bureau of Labor Statistics reports that from June 21 to June 22, the Consumer Price Index is up 9.1% overall. A new 40-year record high.

If we look a little closer at the different components that make up the CPI, we can see some astonishing changes. Gasoline prices are up 60%! Energy commodities are up 60%. These are the areas where we spend a considerable amount of our monthly budget. These are also items we can not do without.

Rents also keep going up. Those currently renting are seeing their rents go up every year at higher rates than in previous years.

The feds are taking measures to halt inflation by increasing interest rates. This will eventually have the desired effect, but for now, everyone is waching their budgets very closely.

Recession Looming

The “R” word seems to be a hot topic on news channels right now. While there is no official declaration of a recession in the US yet, I think most of us are starting to feel it.

The more talk there is about a recession, the more impact that will have on home buyer’s decision to buy. This will put further pressure on the Real Estate market.

What the future holds

One thing we know for sure is; that the future looks more uncertain for the Real Estate market than it has for the past decade. There are significant factors that are having a less-than-ideal impact on the market. The data tells us that.

Another thing we know for sure is that interest rates are going to keep going up. The Feds are pulling out all the stops in attempts to curb the highest inflation rates in 40 years.

The feds have made it clear that one of those tools to curb inflation is to raise interest rates. As of Mid-July 2022, the Feds are expected to raise rates a full 100 basis points (1%) at their next meeting.

Although raising the Fed rate does not directly affect mortgage rates, they closely follow. So we can expect even higher mortgage rates.

The Real Estate market is changing rapidly. In California for exmaple, 6 of the top 10 fastest cooling markets are in our state. Decades of data tell us that real estate trends do not pivot on a dime. Given past market adjustments, I think we can expect the market to continue shifting in the near future.

Now for the real “Million Dollar” question:

Will Home Prices Decline?

Nobody knows for sure, of course, but I will give you some things to consider as well as my perspective on possible price adjustments.

Home prices have risen at an alarming rate across the nation. In Southern California, we have packed three years of appreciation in just the last 12 months. Clearly, that rate of appreciation was not sustainable. Appreciation rates have already started to decline and, in some areas, reverse course. Prices may decrease further, especially as the recession comes to reality and interest rates continue to rise.

A bit of good news, though; two market conditions that may stall a freefall are a shortage of homes for sale and pent-up demand.

Over the past few years, every home that came on the market had up to 100 offers in many cases. Clearly, demand was much higher than the supply of homes available. Let’s say that higher mortgage rates price 50% of home buyers out of the market. So instead of 100 offers on a new listing, we only see 25% of that.. Or 25 offers. And instead of offering hundreds of thousands over the asking price as we saw many times, they offer close to the asking price. That still does not a market crash make.

Also, take into account that builders are slowing down the construction of new homes. In June of 2022, a report shows that housing starts were down 14% since 2021. Supply is not being replenished anywhere near the level needed. We still have a shortage of inventory in the market.

Additionally, all those buyers being priced out of the market now will not forget about buying a home; after all, homeownership is “The American Dream.” In my many years of experience, I anticipate that those buyers will come back on the market within a couple of years. Demand will increase, and if there is a small dip in prices eventually, we are going to recover.

Also, our population is growing by leaps and bounds. That means that families continue to grow, and more people are going to need to buy houses as new households are formed. Not only will we still have those buyers returning to the market after taking a break, but we will also have new buyers looking to buy. Supply and demand economics point to a nice recovery of the market at some point.

Lastly, the factors that led to the last market crash, and the one before that, are not present in this market. The 2006-2008 crash was caused by overleveraged purchases with risky mortgages. Once people saw that they could not afford that house they bought with no money down, there was no reason to hold on to it. Millions of them just walked away. Today, homeowners are very much house-rich. Not only do they have “skin in the game” (Downpayment and equity), but they also have a lot to lose. They are not walking away from an asset with value. We won’t have those massive foreclosure numbers this time around.

The bottom line; the market is shifting, demand is slowing down, appreciation will slow, and home prices will flatten. It will be nothing like that last crash, though. That is good news for homeowners and the Real Estate market overall

Should you sell, buy, or stay put?

Regardless of market conditions, buying a home is a very personal decision. One that should be approached with the right expectations.

A home purchase and the mortgage often attached to it are the biggest financial decisions and commitments most people make in their lifetime. It is only wise to be fully informed about all aspects of that decision.

One approach that rarely turns out well is speculating on the future of the market in the short term.

The best approach is to make a move that you can afford and will serve your goals for many years.

If you are a homeowner and are thinking of selling, there is good news. You can still get top dollar for it at this particular time of the market.

If you are looking to buy, you are in a much better position now than six months ago. You can expect a reasonable negotiating environment. You won’t have to give up things like having the purchase contingent on the appraisal or getting your home loan approved. This is a huge benefit for buyers that had to bend over backward and take risky offer conditions from sellers because they wanted to be competitive on their offer.

As a home buyer, consider buying a home as a long-term investment. Nobody who has looked at home ownership over a long time has come out at a loss. Especially with the shortage of inventory, it is safe to say your home purchase will be safe. It is important that you are prudent about affordability, though. Make sure your budget takes into account your mortgage payment and other costs of home ownership.

How I Can Help

You definitely will need guidance from someone who is active and successful in Real Estate. In your local market. Someone who can put years of experience to work for you, to give you perspectives you may not have considered.

I am fortunate enough to have been selling Real Estate here in Southern California for over 16 years. I have seen a couple of these ups and downs of the market. I have seen people make good decisions and poor decisions.

If you think you can benefit from my market knowledge and experience, reach out to me, and let’s discuss your personal situation. You can reach me at (909) 915-9581he