Soaring Prices, Affordability Plunge, and the Squeezed First-Time Home Buyer

It’s May 2024, and in sun-drenched Southern California, a real estate drama unfolds that’s anything but a Hollywood dream. Bidding wars rage, fueled by desperation and deep pockets.

Young couples, armed with pre-approval letters and hopeful hearts, find themselves outbid time and time again. Meanwhile, sellers, tethered to their ultra-low mortgage rates, watch from the sidelines, hesitant to list their homes and leap into the frenzied market. This is the reality of Southern California’s real estate market today—a turbulent rollercoaster of soaring prices, dwindling affordability, and a first-time homebuyer squeeze that threatens to unravel the entire fabric of the real estate market.

In the epicenter of this real estate storm, we find a perfect storm of converging forces. Home prices have skyrocketed to unprecedented heights, driven by relentless demand and a chronic inventory shortage. Builders struggle to keep pace, hamstrung by regulations and rising costs. At the same time, potential sellers cling to their homes, fearing they’ll never find an affordable replacement and reticent to leap into higher-rate mortgages.

The recent spike in interest rates, a stark contrast to the rock-bottom rates of just two years ago, has further eroded affordability, pushing homeownership out of reach for many aspiring buyers.

The most vulnerable group in this crisis is the first-time homebuyers, the lifeblood of any healthy real estate market. They find themselves locked out of the market, their dreams of homeownership deferred, perhaps indefinitely. This lockout has triggered a domino effect, leaving sellers stranded, unable to move up without a buyer for their current home. The result is a market teetering on the brink of stagnation, with potential consequences that could ripple through the entire economy.

This in-depth article will examine the heart of this crisis, exploring the factors driving the relentless rise in prices, the affordability crunch that’s leaving buyers behind, and the plight of the first-time homebuyer. We’ll examine the proposed solutions and offer expert insights into the future of this volatile market. Buckle up because this is a rollercoaster ride you won’t want to miss.

Skyrocketing Prices and the Inventory Crisis

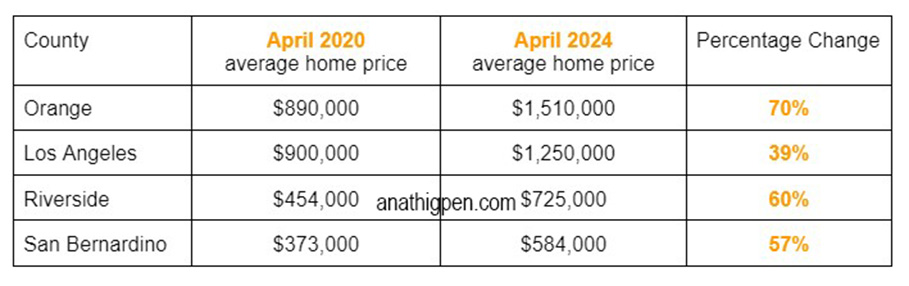

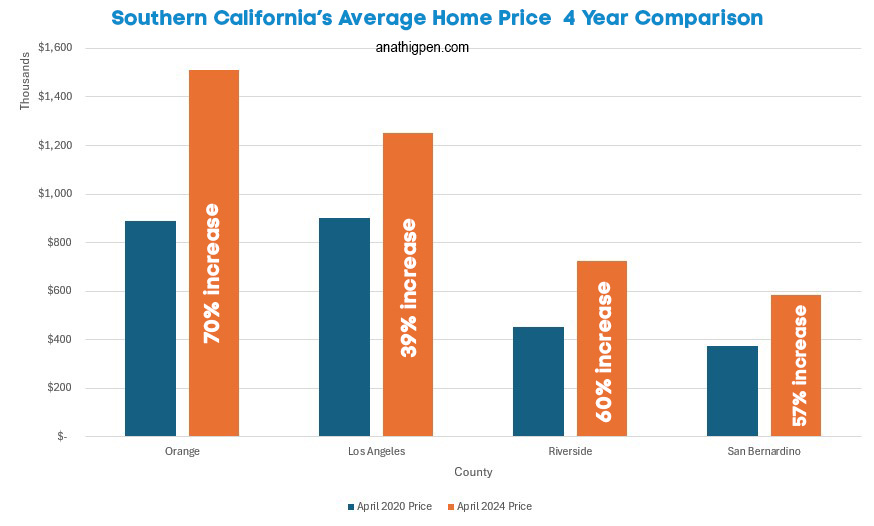

The numbers tell a tale of staggering growth. To give you some perspective, here is what has happened to home prices in the last four years in Southern California:

In Orange County, the average home price hovers around a jaw-dropping $1.5M, a 70% increase from April 2020! While in Los Angeles County, it’s a cool $1.25 million. San Diego County isn’t far behind, with an average price of $1,223,000. The Inland Empire is a bit more moderate, relieving those living in those areas or willing to relocate. The average home price in San Bernardino County is around $585,000, while Riverside County is around $725,000. These figures represent a meteoric rise over the past decade, with prices accelerating at an alarming rate in recent years.

What is shocking about the above numbers is the percentage change in prices, while wages have barely increased. With a 70% increase in home prices and a 124% increase in mortgage rates, we can see a problem brewing here in Orange County. The rest of the Southern California counties are not much different.

What’s fueling this relentless demand? Southern California’s allure is undeniable. Its thriving job market, particularly in the tech and entertainment industries, attracts high earners from across the country and the globe. The region’s enviable lifestyle, year-round sunshine, stunning beaches, and cultural diversity are powerful drawcards. Historically low interest rates, which until recently hovered around 3%, further fueled the fire, making homeownership more accessible (at least on paper) to a wider pool of buyers.

Yet, the supply side of the equation tells a different story. Southern California is grappling with a severe housing shortage, exacerbated by a complex web of factors. Stringent building regulations and zoning restrictions, particularly those that favor single-family homes over higher-density housing, stifle development. Construction costs, from labor to materials, have skyrocketed, further discouraging builders. The scarcity of available land, especially in desirable coastal areas, limits new construction opportunities.

Moreover, a peculiar phenomenon has emerged, dubbed the “rate lock.” Homeowners who secured ultra-low mortgage rates in recent years are reluctant to sell, knowing they’ll likely face significantly higher rates on a new loan. This hesitancy has created a bottleneck in the market, with fewer existing homes coming up for sale, further exacerbating the inventory shortage.

The absence of “missing middle” housing – that is, moderately priced options like townhomes, duplexes, and triplexes – has also contributed to the affordability crisis. This lack of diversity in housing types leaves many buyers with a stark choice: either stretch their budgets to the limit for a single-family home or settle for a less desirable property.

The result is a market where buyers are forced to compete fiercely for a limited pool of homes, often resorting to desperate measures like waiving contingencies, offering above asking price, and even resorting to all-cash offers. This hyper-competitive environment has pushed prices to dizzying heights, leaving many would-be buyers feeling priced out and frustrated.

Affordability Crisis and the Rate Shock

The recent and rapid rise in interest rates has dramatically exacerbated the affordability crisis plaguing Southern California’s real estate market. Just three years ago, in 2021, the average interest rate on a 30-year fixed-rate mortgage hovered around a historically low 3.25%. Fast-forward to the second quarter of 2024, and that same mortgage now commands an interest rate closer to 7.25%.

The impact of this rate shock on affordability cannot be overstated. Consider a buyer purchasing a $900,000 home with a 20% down payment. At a 3.25% interest rate, their monthly payment (excluding taxes and insurance) would be approximately $3,133. At 7.25%, that same payment balloons to over $4,912 – a staggering increase of more than 50%.

This surge in mortgage rates has dramatically shrunk the pool of qualified buyers. Many potential buyers who were previously pre-approved for loans now find themselves falling short of the stricter lending standards imposed by lenders grappling with the higher-rate environment. This has led to a shift in buyer demographics, with investors, who often have access to cash and are less reliant on financing, gaining an even stronger foothold in the market.

The prevalence of all-cash offers further exacerbates affordability issues. These offers, often made by investors or wealthy individuals, are particularly attractive to sellers in a competitive market. They eliminate the risk of financing falling through and can often close more quickly than offers contingent on a mortgage. However, competing with all-cash offers is nearly impossible for buyers who rely on financing.

The result is a double-edged sword. Rising rates and the prevalence of all-cash offers are pricing out a significant portion of potential buyers, particularly first-time buyers and those with moderate incomes. This, in turn, could lead to a slowdown in the market as fewer buyers are able to participate. However, the scarcity of homes and continued demand from those who can afford to pay top dollar, whether through cash or higher-rate mortgages, are keeping prices elevated, at least for now.

The affordability crisis is a complex issue with no easy solutions. Some experts suggest that the market may eventually correct itself as higher rates cool demand and sellers are forced to adjust their expectations. Others warn of a potential housing bubble, fueled by unsustainable price growth and a shrinking pool of buyers. Regardless of the outcome, the affordability crisis is a stark reminder of the challenges facing homebuyers in Southern California’s increasingly competitive and expensive real estate market.

The First-Time Homebuyer Squeeze and the Domino Effect

The dream of homeownership is becoming increasingly elusive for first-time buyers in Southern California. A confluence of factors, from skyrocketing prices to the recent surge in interest rates, has created a formidable barrier to entry. The challenges facing these aspiring homeowners are manifold and daunting.

Firstly, the sheer cost of a down payment is a major hurdle. With median home prices in many Southern California counties well into the seven figures, even a 20% down payment can easily exceed $200,000. Saving such a substantial sum is a Herculean task for many young people and families, especially amidst rising rents and inflationary pressures. The California Housing Finance Agency (CalHFA) offers various down payment assistance programs, but qualifying for these programs can be difficult, and the assistance often falls short of covering the full down payment amount.

Secondly, the fierce competition from all-cash offers further diminishes the chances of first-time buyers securing a home. Sellers, understandably, favor the certainty and speed of cash offers, often leaving buyers who rely on financing empty-handed. This trend is particularly prevalent in hot markets like Los Angeles and Orange County, where bidding wars are commonplace, and buyers are often forced to make aggressive offers to even be considered.

Thirdly, the difficulty of saving for a down payment is compounded by the rising cost of living in Southern California. Rent prices have soared in recent years, consuming a significant portion of many potential buyers’ incomes. Inflation has further eroded purchasing power, making it even harder to set aside money for a down payment.

This first-time homebuyer squeeze has triggered a domino effect reverberating throughout the market. Existing homeowners who might otherwise consider moving up to a larger home or a different neighborhood are reluctant to do so, knowing they’ll face the same daunting challenges as first-time buyers. This “locked-in” seller phenomenon further constricts the already limited inventory, making it even harder for buyers at all levels to find suitable homes.

The lack of starter homes, the traditional stepping stones into homeownership, is a critical piece of this puzzle. Without affordable entry-level options, first-time buyers are forced to overextend themselves financially or remain renters, delaying their entry into the housing market. This, in turn, prevents existing homeowners from moving up, creating a bottleneck that impacts the entire chain of transactions.

The consequences of this domino effect are far-reaching. A stagnant market with reduced transaction volume can lead to a slowdown in economic activity, as real estate plays a crucial role in generating jobs and stimulating spending. The lack of affordable housing can also exacerbate social inequalities, as homeownership is a key driver of wealth accumulation and financial stability.

Potential Solutions and Outlook

The challenges facing Southern California’s real estate market are complex and deeply ingrained but not insurmountable. Policymakers, developers, and community leaders are exploring a range of potential solutions to increase housing supply, improve affordability, and create opportunities for first-time buyers.

One key area of focus is zoning reform. Many experts argue that overly restrictive zoning regulations, particularly those that prioritize single-family homes, are a major impediment to housing development. By relaxing zoning restrictions and allowing for higher-density housing, such as townhomes and apartment buildings, cities could unlock significant development potential and increase the supply of affordable housing. Some cities, like Los Angeles, have already taken steps in this direction, adopting policies that streamline approvals for accessory dwelling units (ADUs) and other forms of multi-unit housing. The Terner Center for Housing Innovation at UC Berkeley provides in-depth research on housing policy and zoning reform:

Another approach is to incentivize the construction of affordable housing. This could involve offering tax breaks or other financial incentives to developers who build affordable units or creating public-private partnerships to fund affordable housing projects. The California Department of Housing and Community Development (HCD) administers various programs aimed at promoting affordable housing development:

Exploring alternative financing models for first-time buyers is another avenue for improving affordability. This could include down payment assistance programs, shared equity mortgages, or even rent-to-own arrangements. Organizations like the California Association of Realtors (CAR) are advocating for policies that expand access to affordable financing options for first-time buyers.

The outlook for Southern California’s real estate market remains uncertain. Some experts predict that the recent rise in interest rates will eventually cool demand, leading to a moderation in price growth and a more balanced market. Others warn that the underlying factors driving the housing shortage, such as limited land availability and high construction costs, will continue to exert upward pressure on prices.

The role of technology in the real estate market is also evolving. Online platforms like Zillow and Redfin have transformed how buyers and sellers access information and connect with agents. However, the rise of iBuyers, companies that use algorithms to make instant cash offers on homes, is a controversial development that some argue could further disadvantage individual buyers and exacerbate affordability issues.

A combination of policy decisions, economic trends, and technological innovations will likely shape the future of Southern California’s real estate market. Addressing the affordability crisis and creating opportunities for first-time buyers will require a multi-faceted approach involving collaboration between government agencies, developers, community organizations, and the real estate industry.

While the challenges are significant, there is also reason for optimism. The growing awareness of the housing crisis and the increasing demand for affordable housing create a sense of urgency and a renewed focus on finding solutions. By working together, stakeholders can create a more equitable and sustainable real estate market that benefits all Californians.

Bottom Line

The Southern California real estate market is currently navigating a tumultuous landscape. Fueled by relentless demand and a chronic inventory shortage, soaring prices have created an affordability crisis that’s squeezing out first-time buyers and leaving many would-be sellers stuck in place. The recent surge in interest rates has further exacerbated the situation, pushing homeownership out of reach for many Californians.

The consequences of this crisis extend far beyond the individual struggles of buyers and sellers. A stagnant real estate market can dampen economic growth, limit job creation, and exacerbate social inequalities. The lack of affordable housing options also has serious implications for residents’ quality of life and well-being, as it can lead to overcrowding, long commutes, and financial stress.

While the challenges are daunting, there is also hope on the horizon. Policymakers, developers, and community leaders are actively exploring solutions to increase housing supply, improve affordability, and create opportunities for first-time buyers. Zoning reforms, incentives for affordable housing development, and innovative financing models are just some of the strategies being considered.

The future of Southern California’s real estate market is uncertain, but one thing is clear: the status quo is unsustainable. Addressing the affordability crisis and ensuring that homeownership remains viable for future generations will require a concerted effort from all stakeholders. This includes government action, industry initiatives, and a shift in cultural attitudes towards housing and community development.

The dream of homeownership should not be a luxury reserved for the wealthy few. It is a fundamental aspiration that contributes to individual well-being, family stability, and community vitality. By working together to address the challenges facing the Southern California real estate market, we can create a more equitable and sustainable future for all residents.