Concerns about a potential recession have been a hot topic recently, and understandably so. The notion of a looming recession has raised fears among many about the potential for a significant increase in unemployment. This, in turn, has led to concerns about a possible surge in foreclosures, reminiscent of the challenging period we faced about 15 years ago.

Yet, there’s a silver lining, as indicated by the most recent Economic Forecasting Survey from the Wall Street Journal (WSJ). This survey brings a wave of optimism, showing a notable shift in economists’ outlook on the likelihood of a recession. For the first time in over a year, fewer than half of the economists surveyed (48%) anticipate a recession occurring in the next 12 months. This marks a decrease from the 54% recorded in July, signaling a growing optimism about the economy’s trajectory.

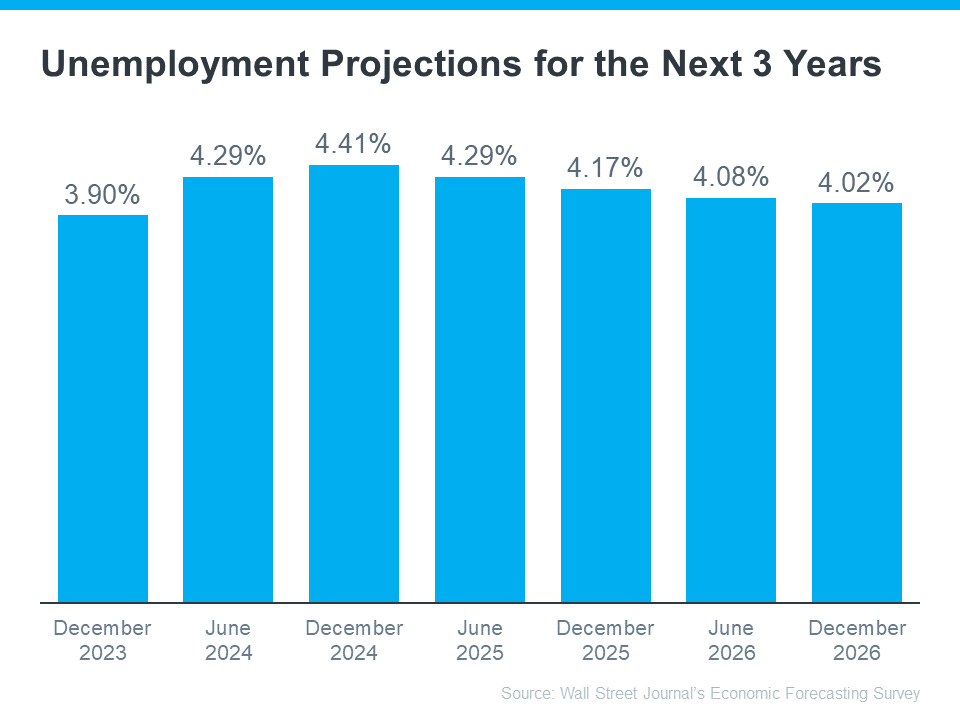

When considering these updated projections, it’s logical to deduce that these experts also foresee a stable unemployment rate. The accompanying graph, sourced from the same WSJ survey, illustrates the economists’ expectations for the unemployment rate over the coming three years.

While any increase in job losses is concerning and has a profound impact on affected individuals and their families, it’s important to examine the broader implications for the housing market. Specifically, the question arises: Will potential job losses be significant enough to trigger a wave of foreclosures, potentially destabilizing the housing market?

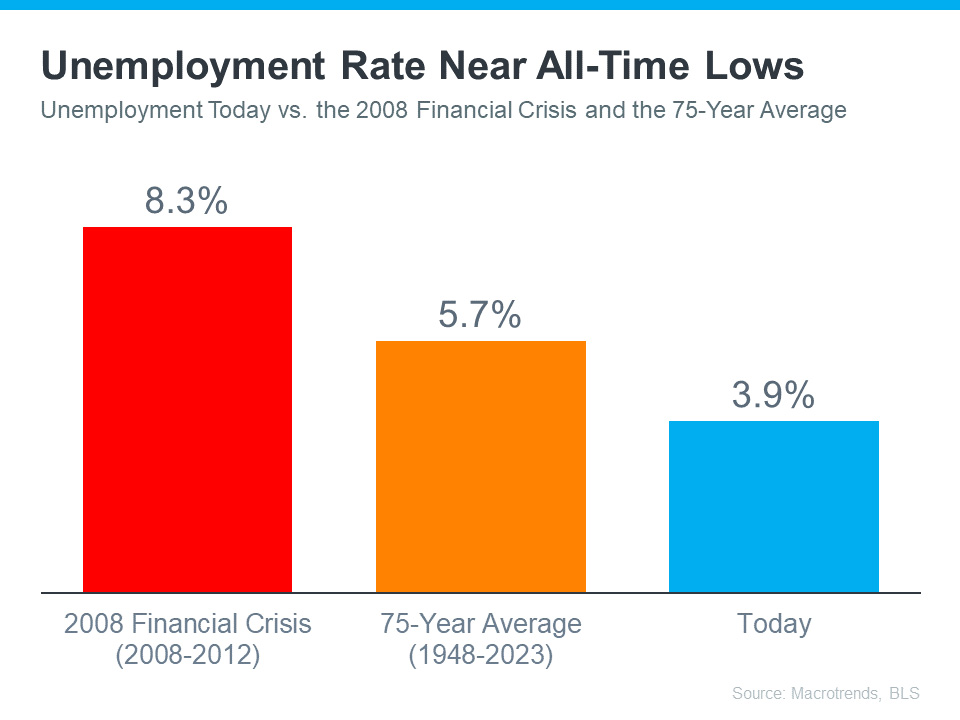

Historical data from Macrotrends and the Bureau of Labor Statistics (BLS) offers valuable context. Currently, the unemployment rate hovers near historic lows. To put this in perspective, the average unemployment rate since 1948 stands at 5.7%. During the aftermath of the 2008 financial crisis, which led to a housing market crash, the unemployment rate peaked at 8.3%. These figures are substantially higher than today’s unemployment rates.

Looking ahead, projections suggest that the unemployment rate is likely to remain below the 75-year average. This trend bodes well for the housing market, as it reduces the likelihood of a foreclosure wave that could significantly impact it.

Bottom Line: The consensus among most economists is that a recession in the next 12 months is becoming less likely. Consequently, they also do not foresee a dramatic spike in unemployment leading to widespread foreclosures and a housing market crash. If you’re curious about how unemployment might affect the housing market, especially here in the Inland Empire, let’s have a conversation. Our local market has its unique dynamics, and I’m here to help you navigate them.