Amid economic volatility and speculation, the housing market has remained remarkably resilient. Despite earlier concerns and sensational headlines predicting a collapse in 2023, the reality is far from the painted doomsday scenarios.

Among other reports, here are some examples of what we saw in some publications:

During the fourth quarter of last year, many housing experts predicted home prices were going to crash this year. Here are a few of those forecasts:

Jeremy Siegel, Russell E. Palmer Professor Emeritus of Finance at the Wharton School of Business:

“I expect housing prices to fall 10% to 15%, and housing prices are accelerating on the downside.”

Mark Zandi, Chief Economist at Moody’s Analytics:

“Buckle in. Assuming rates remain near their current 6.5% and the economy skirts recession, then national house prices will fall almost 10% peak-to-trough. Most of those declines will happen sooner rather than later. And house prices will fall 20% if there is a typical recession.”

Goldman Sachs:

“Housing is already cooling in the U.S., according to July data that was reported last week. As interest rates climb steadily higher, Goldman Sachs Research’s G-10 home price model suggests home prices will decline by around 5% to 10% from the peak in the U.S. . . . Economists at Goldman Sachs Research say there are risks that housing markets could decline more than their model suggests.”

The Bad News: It Rattled Consumer Confidence

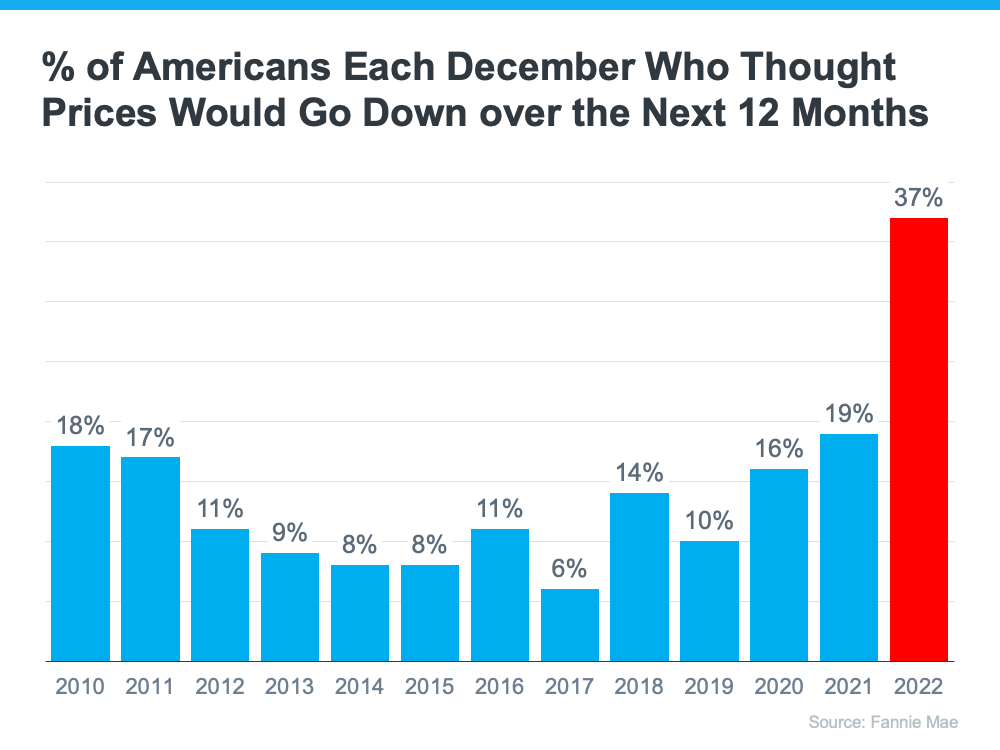

These predictions have raised concerns among consumers regarding the stability of the residential real estate market. This skepticism is supported by the findings of the December Consumer Confidence Survey conducted by Fannie Mae, where a significant proportion of Americans believed home prices would decline in the coming year.

In fact, this December marked the highest percentage of individuals anticipating a decrease in home prices since the inception of the survey (refer to the graph below). Consequently, this uncertainty has led many people to pause and reevaluate their plans to buy or sell homes as we entered the new year.

In this article, I will provide a comprehensive analysis of the housing market’s current state and debunk the wild speculations that have caused unnecessary concerns.

Factors Influencing the Housing Market

To understand why the housing market has not crashed, we must understand the key factors contributing to its stability and resilience. While numerous elements impact real estate trends, the following aspects have played a significant role in maintaining a robust market:

1. Housing supply shortage

One of the primary drivers of the housing market is the persistent shortage of housing supply. Demand for housing has remained strong despite higher rates and an inflationary environment. Factors such as population growth and a stable economy have contributed to a consistent demand for homes, thereby preventing a significant price drop.

2. Economic Strength

The economy’s overall health is closely intertwined with the housing market’s performance. The economy has shown remarkable resilience in recent years, with steady growth and low unemployment rates. A strong economy encourages consumer confidence and boosts purchasing power, stimulating the housing market and preventing a crash.

3. Government Policies and Regulations

Government policies and regulations have a substantial impact on the housing market. Over the years, authorities have implemented measures to ensure stability and curb excessive speculation. Stringent lending practices and tighter regulations have acted as safeguards against unchecked growth and have helped maintain a sustainable real estate environment.

4. Favorable financing options

Even though mortgage rates have risen from the past decade’s historically low levels, financing is readily available. With so many lending options available and mortgage rates still relatively affordable historically, buyers are finding plenty of opportunities to purchase a home.

Dispelling Wild Speculations

Despite the prevailing market conditions, talk about a possible market correction still circles the news, causing unnecessary fear and uncertainty.

It is important to address and debunk these unfounded claims to provide clarity and reassurance to potential homebuyers and investors.

1. Speculation: “Housing Bubble Burst Imminent!”

The notion of a housing bubble on the verge of bursting has been a recurring concern. However, a thorough analysis reveals that the market fundamentals do not support such claims. The supply shortage and resilient demand dynamics, coupled with sustainable economic growth, indicate that the housing market is on a solid foundation. While localized corrections may occur, a nationwide crash is highly unlikely.

2. Speculation: “Price Collapse in 2023!”

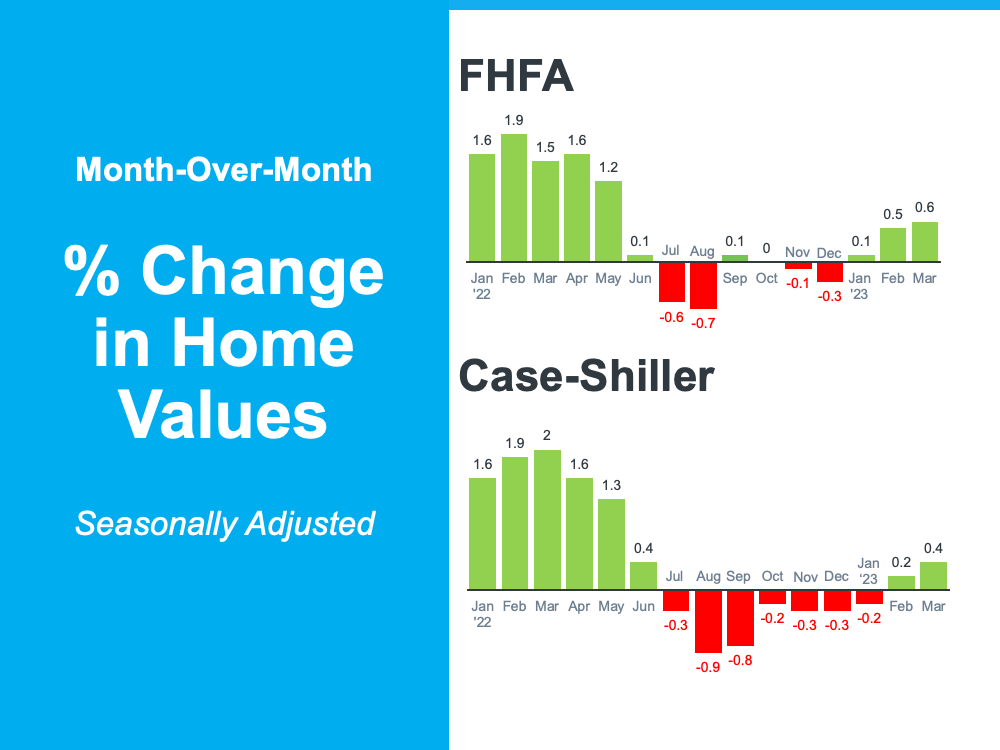

Predictions of a price collapse in 2023 have captured headlines and fueled anxiety. Yet, these forecasts fail to account for the intricate interplay of various market factors. The current housing market exhibits resilience, with prices showing steady growth or stabilization in most regions. While localized fluctuations can be expected, a nationwide collapse is unsupported by empirical data. As a matter of fact, prices are already rebounding from the minimal adjustmet we saw over the last few months of 2022 and the early part of 2023. In a report recently released, Goldman Sachs explained:

“The global housing market seems to be stabilizing faster than expected despite months of rising mortgage rates, according to Goldman Sachs Research. House prices are defying expectations and are rising in major economies such as the U.S.,. . . ”

Those claims from Goldman Sachs were verified by the release last week of two indexes on home prices: Case-Shiller and the FHFA. Here are the numbers each reported:

3. Speculation: “Market Overheated – Time to Sell!”

Reports suggesting that the market has overheated and urging homeowners to sell immediately can be misleading. It is true that some regions have experienced rapid price appreciation, but this is not indicative of an imminent crash. Homeowners should consider the long-term prospects of their investments and make informed decisions based on their individual circumstances.

Final Thoughts

Contrary to the speculation rumors that have circulated, the housing market has not crashed in 2023. The market’s resilience can be attributed to various factors, including a housing shortage and unmet demand, a strong economy, government regulations, and favorable mortgage rates. By debunking the unfounded claims and providing a comprehensive analysis, we can have a clearer understanding of the current state of the housing market.

As prospective buyers and investors navigate the ever-evolving real estate landscape, it is imperative to base decisions on accurate information and avoid succumbing to sensationalism. The housing market, though subject to fluctuations, continues to present opportunities for individuals and families seeking stable and prosperous homeownership.

If you are considering making a move within the Inland Empire, feel free to reach out with any questions you may have about our local market. I’d be delighted to share my many decades of experience in the local market and guide you to make the most prudent move for your goals.