A Significant Drop in Inflation

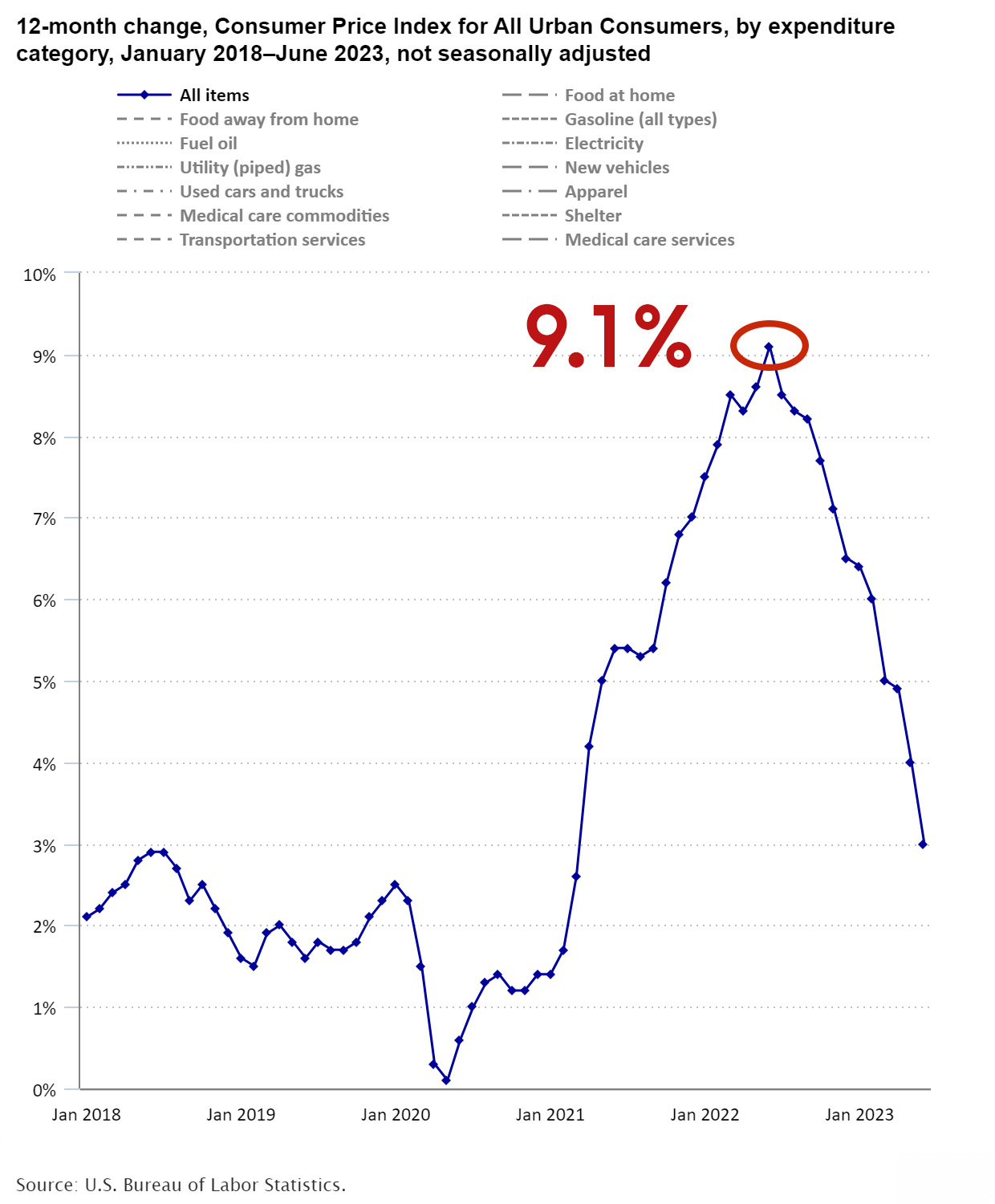

We’re halfway through 2023 and the U.S. economy has just received some great news. The inflation rate, which stood at a challenging 9.1% in June 2022, has remarkably been reduced to a comfortable 2.97% as of June 2023. This significant decline is a testament to the Federal Reserve’s assertive policy of raising interest rates, a strategy that started in March 2022 and was consistently applied throughout the year.

Enhanced Purchasing Power

The first noticeable benefit of this reduction in inflation? Better purchasing power. As inflation takes a backseat, our money retains its value, and we can get more for every dollar we spend. This is not just good news for consumers, but also for businesses, making long-term planning and investments more feasible.

Good News for Home Buyers

If you’re planning to buy a house, the timing couldn’t be better. Over the past year, mortgage rates have moved in line with the Fed’s rates, demonstrating a correlation even if not directly linked. Now, as the Federal Reserve is likely to loosen its grip on interest rates, we can anticipate a corresponding easing in mortgage rates. This translates into more affordable homeownership, which is certainly a reason to celebrate.

Boost in Investor Confidence

Lower inflation is also a significant morale booster for investors. High inflation can create an uncertain investment environment, causing investors to be more cautious. However, with the recent dip in inflation, there’s a sense of stability that can encourage investors to venture more boldly, benefiting businesses and the stock market.

Implications for Global Markets

The positive effects of lower U.S. inflation aren’t confined within our borders, they’re resonating on a global scale too. When the U.S. grapples with high inflation, it can create fluctuations in global currencies against the U.S. dollar. But now, with easing inflation, we’re likely to see more stability in the international currency markets, fostering an environment conducive to global trade and economic development.

More Room for the Fed Last but not least, the decline in inflation allows the Federal Reserve greater flexibility in its monetary policy. With lower inflation, the Fed has more leeway to respond to economic downturns, including potentially lowering interest rates.

Looking Ahead

In conclusion, the mid-2023 announcement of lower inflation is certainly a welcome piece of news. It brings with it several positive repercussions, including an era of more affordable home ownership, bolstered investor confidence, global currency stability, and greater monetary policy flexibility.

As we anticipate the Federal Reserve gradually easing its stringent anti-inflationary policy, these positive effects could potentially amplify, making the rest of 2023 a promising period for the economy. Higher real returns for investors, wage growth outpacing inflation, and increased affordability for home buyers paint a positive picture for the coming months.